HOT SALE

APPLICATION

Phone:+86-15215969856 E-Mail: 396838165@qq.com

The global sublimation printing market is facing a significant upheaval. In June 2025, the U.S. Department of Commerce started the third “sunset review” of anti-dumping and countervailing duties on lightweight thermal paper imported from China. This is not a lone event. It fits into a wider trade fight. That fight grew worse in October 2025. At that time, China began adding special port fees on U.S. vessels. They did this as a payback after the U.S. said it would add similar fees on Chinese ships. For U.S. print shops, this mix of high tariffs and higher shipping costs brings a tough problem. It has never happened before. And it could change supply chains and how businesses compete. This article will break down what these changes mean for your business and how to navigate them successfully.

The Impact of US Tariffs on Profits

Tariffs like these don’t just add a line item to your invoice—they erode margins and force tough decisions on pricing and inventory. For US print shops specializing in dye sublimation ink and sublimation printer setups, the effects ripple through every order. Let’s dive into the specifics of this tariff rate and what it means for your bottom line.

Decoding the 130% Tariffs

The US government’s move builds on existing duties. Previous anti-dumping duties on Chinese sublimation paper were as high as 115.29%. Now, with the additional 100% tariff starting November 1, 2025, the total effective rate hits around 130%. This means the cost of importing a roll of heat transfer paper from China could more than double overnight.

Think about a standard roll of sublimation transfer paper. Before these changes, you might pay $50 per roll from a Chinese sublimation paper manufacturer. Add the new tariffs, and that jumps to over $115, not counting shipping. For dye sublimation paper used in high-volume printing, this escalation hits hard. The US Trade Representative’s office listed categories like communication products and core materials, but sublimation supplies often fall under broader manufacturing imports, making them vulnerable.

China’s response adds another layer. On October 9, 2025, they imposed export controls on rare earths and key materials, which could indirectly affect sublimation ink production. Rare earths are vital for dyes in dye sublimation ink, and China controls about 87% of global refining. If supplies tighten, prices for sublimation ink could rise 10-20% globally, based on past trade disruptions. In the long run, all suppliers will have to pay for this. Printers need to review their current contracts now. Please carefully review the contract terms with the sublimation paper manufacturer to understand any provisions regarding tariff adjustments.

Calculate the Real Cost to Your Business

Beyond the tariffs themselves, logistics fees compound the problem. Starting October 14, 2025, American ships docking at Chinese ports will be required to pay special port fees. Some analysts estimate that a large American container ship may face fees of up to $1 million per voyage after the policy takes effect.

Break it down for a typical shipment. Suppose you order 1,000 rolls of dye sublimation paper. Pre-tariff shipping might cost $5,000 for a container from Shanghai to Los Angeles. Now, add China’s port fees: for a ship with 10,000 net tons, the initial fee is 400 yuan per ton, or about $56,000 total. These fees apply per voyage, but only at the first Chinese port, with a cap of five charges per year per ship. Still, for frequent importers, it’s a big hike. US Customs and Border Protection is mirroring this with fees on Chinese ships, creating a cycle of escalating costs.

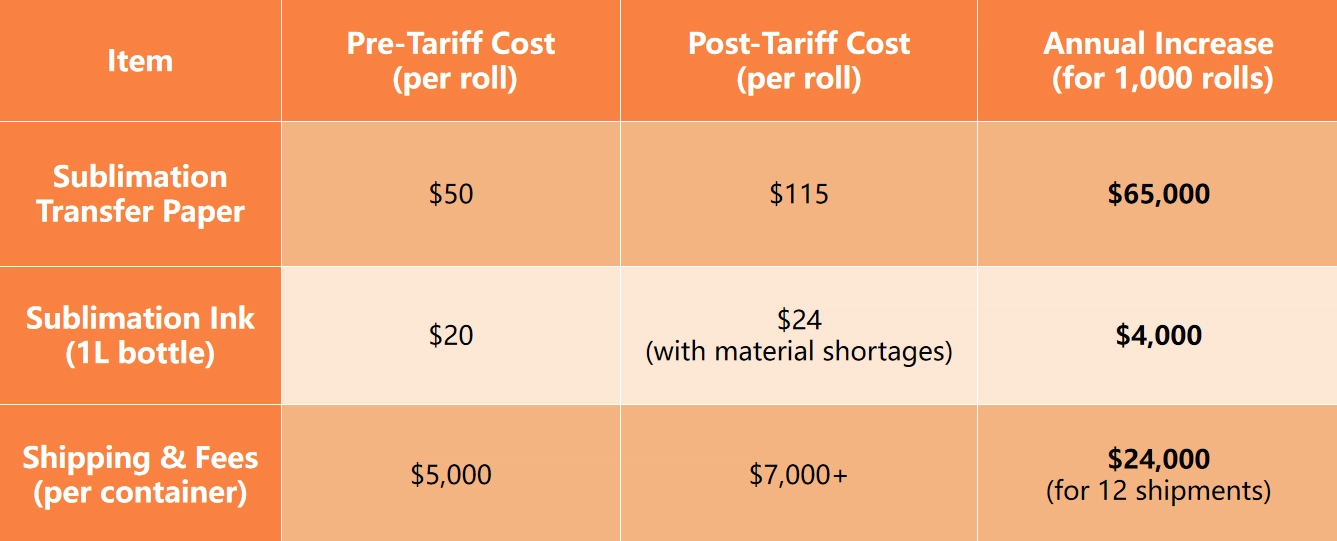

To quantify for your shop, use this simple table to estimate impacts:

This table assumes moderate volumes. Scale it up for larger operations, and the numbers grow fast. Factor in potential delays: administrative checks could add 3-5 days per shipment, tying up capital in inventory.

The real cost isn’t just dollars—it’s opportunity. Higher prices might push customers to competitors with domestic sources. Or, you might need to raise your own rates, risking lost business. Print shops must run these calculations now to forecast cash flow through 2026.

Navigate New Supply Chain Challenges

With tariffs reshaping imports, US print shops must address the full chain from manufacturer to your door. Sublimation printer paper and inks from China have been reliable and cheap, but now reliability is in question. New hurdles mean rethinking how you get materials without disrupting production.

The Double Squeeze of Tariffs and Logistics

Tariffs hit the product price, while logistics fees attack the delivery. New fees and potential administrative hurdles could lead to further delays and increased cost uncertainty. China’s port fees start at 400 yuan per net ton, scaling up yearly. For a US-owned ship carrying sublimation paper, this adds thousands per trip. Reciprocal US fees on Chinese vessels mean exporters might pass on extra costs, inflating your invoice for dye sublimation paper.

Delays are another issue. Export controls on rare earths could slow sublimation ink production, as these elements enhance color vibrancy. If factories face shortages, lead times for sublimation transfer paper might extend from 4 weeks to 8-10 weeks.

Global shipping is already tight. The trade war could divert routes to Southeast Asia, but that adds distance and cost. A shipment rerouted via Vietnam might cost 15% more and take an extra week.

Strategies for Smoother Shipping

To mitigate these impacts, it is crucial to plan for buffer times and work closely with your logistics partners.

Start with diversification in shipping. Use non-US flagged vessels to dodge some fees—many carriers are international. Partner with forwarders experienced in Asia-Pacific routes. The second is to plan buffer time. Order 20-30% more lead time for key items like dye sublimation ink. Use software to track shipments in real-time, spotting delays early. Negotiation with suppliers is equally important. Ask your sublimation paper manufacturer for flexible terms, like partial shipments or price locks before tariffs fully hit.

Consider these steps in a checklist:

I. Audit current suppliers for tariff exposure.

II. Explore bonded warehouses in neutral ports to defer duties.

III. Insure shipments against policy changes.

IV. Join industry groups for updates on trade rules.

These tactics help smooth the flow. But to thrive, print shops need more than survival—they need strategies that turn challenges into edges.

Smart Strategies for US Print Shops

Adapting to tariffs means evolving your business model. US print shops can offset hits to sublimation paper costs by getting smarter about sources, tools, and partners. This isn’t about quick fixes; it’s building resilience for the long haul.

Diversify Your Supply Sources

Many companies are turning to emerging markets in Southeast Asia and Latin America to avoid the risks of the US-China trade war. Yet, new paper varieties must be thoroughly tested to ensure quality and compatibility.

Vietnam and Indonesia are rising as hubs for sublimation transfer paper. These countries offer lower tariffs under trade agreements, with costs 10-15% below post-tariff Chinese prices. For dye sublimation paper, look for mills certified for color fastness. Domestic options grow too. US-based sublimation paper manufacturers are scaling up, though at higher base prices. Blending sources—60% from Asia, 40% local—reduces risk.

Invest in Efficiency to Offset Costs

When material costs go up, running smooth becomes your best tool for keeping earnings safe. Putting money into high-output, low-waste printing gear is a smart step. It helps balance rising input costs.

Modern, smooth printers not only save ink and cut paper waste. They also boost how much you can make. This lets you handle more work without extra costs growing the same way. So, it softens the hit from higher paper prices. Changfa Digital has been deeply involved in the digital printing industry for decades, boasting a comprehensive product line, offering a comprehensive range of high-quality products, from printers to sublimation paper and ink. We consistently prioritize innovation and independent research and development. Our products are ISO 14001 certified and China National Laboratory certified, ensuring maximum profitability with minimal downtime, ink, and paper consumption.

Partner with Experts Who Understand the New Trend

In a tricky and shifting trade world, a smart partner is worth a lot. Changfa Digital knows the global thermal transfer paper market well. We understand trade walls. So, we can help you handle these changes. We can aid in finding steady, cheap supply chain fixes. And we give high-consistency sublimation paper. This keeps your print quality top, even in a rough market.

Conclusion

The 130% tariff on Chinese sublimation paper and the additional logistics costs from reciprocal port fees represent a significant inflection point for the U.S. printing industry. While these changes are disruptive, they also present a clear imperative: to build a more resilient, efficient, and diversified business model. By proactively managing your supply chain, investing in operational efficiency, and collaborating with the right partners, you can not only weather this storm but also emerge stronger. The shops that adapt swiftly will find themselves with a lasting competitive advantage in the new era of global trade.

Changfa Digital can help you find reliable, cost-effective supply chain solutions. Contact us now at 396838165@qq.com and we’ll help you quickly adapt to the changing trade environment, and gain a lasting competitive advantage in the new global trade landscape!